HOW MUCH MONEY DO PEOPLE YOUR AGE USUALLY SAVE? SEE HOW YOU COMPARE

Savers are still managing to put money away despite two years of high inflation, rising food and energy costs and increasing mortgage or rent payments.

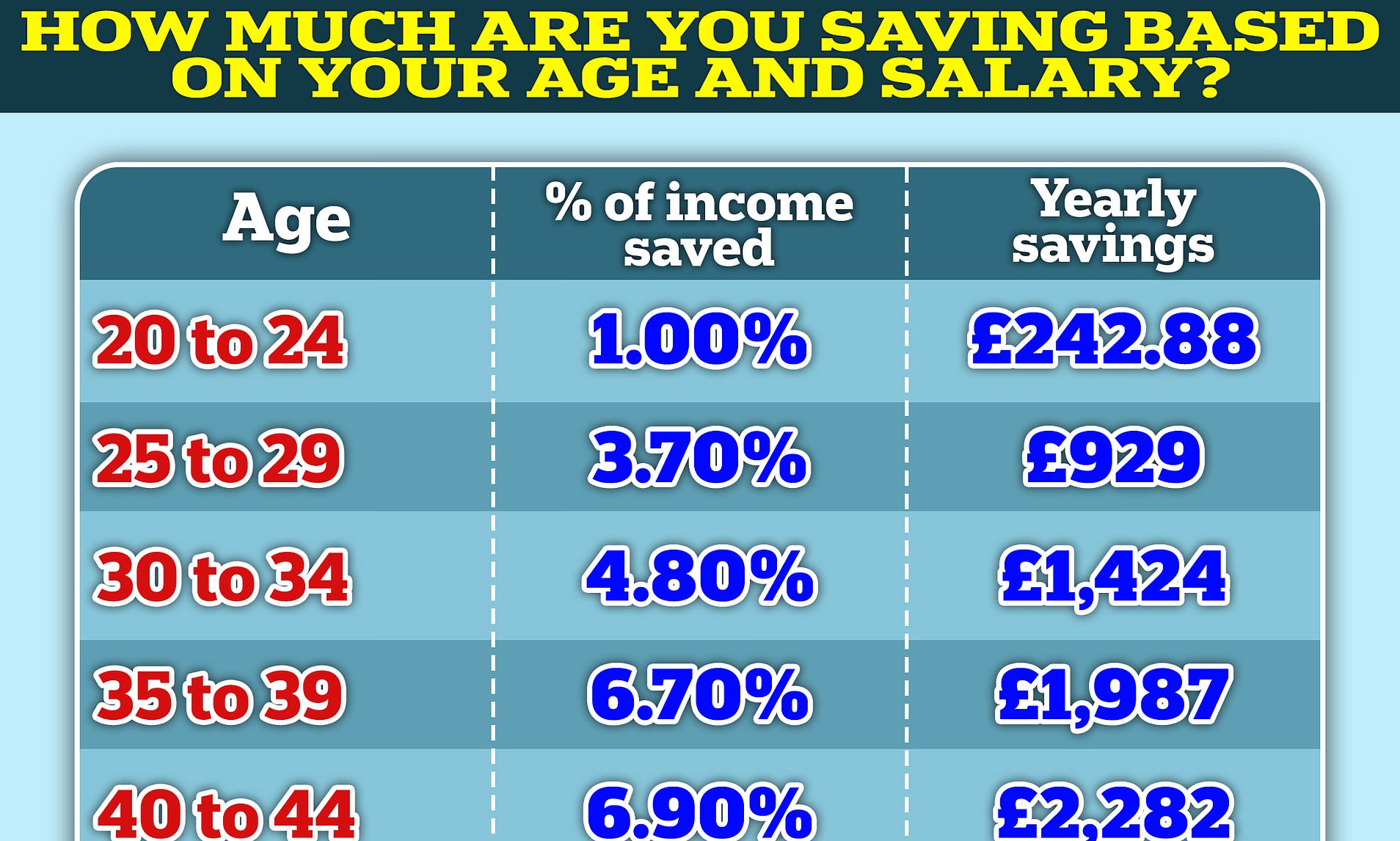

But how much are people saving each year, and how does that change depending on what stage of life they are in?

Over half of 25–29 year olds are putting aside 3.7 per cent of their annual income for the future, a new report from investment platform Hargreaves Lansdown suggests.

The average annual salary for this age group is around £30,000, according to figures from the ONS.

Those aged 25 to 29 who earn around £2,000 a month after tax put away 3.7 per cent of their earnings, saving around £75 a month.

In the 35 to 39 year-old bracket, 64 per cent of households manage to squirrel away some money, and save on average 6.7 per cent of their annual income.

The average annual salary for this age group is £36,320 according to figures from the ONS, so after tax, this age bracket manages to put £1,987 into savings a year, or £165 a month.

Those aged 40 to 44 have savings equalling 6.9 per cent of their annual income.

On an average salary of around £41,000 after tax, this age group would be able to save £2,279 a year or £189 a month.

Savings rates peak in your 40s according to Hargreaves Lansdowne. This is also the case for average annual pay which fell to £38,368 amongst 50 to 59 year olds.

Is it enough?

Personal finance experts recommend you should keep between three to six months' worth of household outgoings as an emergency fund.

It should be enough to cover your rent or mortgage payments, utility bills, food and childcare, and should be held in an account you can access at a moment's notice should you have a change in circumstances.

Despite being able to put some money into savings, it is plain to see that younger generations are lagging behind older counterparts when it comes to the amount they are putting away, saving far less as a percentage of income than other age groups.

If a 25-year-old earning the average £2,000 per month post-tax salary saved 3.7 per cent of their income, that would be £75 a month.

Even if they had been doing that for a couple of years, they would only have £1959 saved - leaving them with less than one month's salary to rely on if they had a financial emergency.

Emma Wall, head of investment analysis and research at Hargreaves Lansdown said: 'We recognise the pressures that younger [people] are under – rising rents and bills, student debt, inflation – so the levels of savings that this cohort is still managing to acquire is impressive.

'Yes, it is lower than other age groups, but that is not unexpected. What is important is that where possible people build their resilience over time, so that as life's curve balls hit, they are best equipped to deal with them.'

Those who took part in the HL Savings and Resilience Barometer research are the 'head of the household', which for younger people means they are living independently, not with their parents.

Those still in the family home are likely to be able to amass more of a rainy day fund.

The percentage of people with no spare cash at the end of each month nearly doubled between 2022 and 2023, findings from Nationwide Building Society suggest.

The percentage of households with zero cash left at the end of the month rose from 11 per cent in 2022 to 21 per cent in 2023.

More than one in five, or 22 per cent, of households have less than £100 going spare at the end of the month, compared to just 13 per cent in 2021, Nationwide said.

Saving and investing tips to build wealth

When it comes to wealth generation and financial resilience, cash savings for emergency spending and investments for the longer term are both important and each has a role to play.

For those looking to build up a cash buffer, savers could consider putting their money in one of the best easy-access accounts. That way they can build up their emergency fund while getting a guaranteed rate of return.

At the moment, the best easy-access accounts pay upwards of 5 per cent. Hampshire Trust Bank pays an interest rate of 5.06 per cent and you can make deposits from just £1.

> Find the best buy easy-access savings rates using our tables

After putting aside sufficient emergency savings, someone could consider investing to help you meet their medium-to long-term financial goals, such as retirement.

Another option is to look at fixed-rate savings accounts, where you lock your money away for a certain period in exchange for a higher return.

Emma Wall says: 'If you are investing for the first time, steer clear of stock-picking. Instead, look for broad market exposure, for a low cost, such as an iShares ACWI ETF – invested in more than 2,000 companies from both developed and emerging markets.

'This is a great core option for first time investors, to which you can add satellite holdings that reflect your outlook or interests. Note this ETF is invested in all stocks, which should deliver better longer-term returns than other asset classes but can be volatile on the way there.

'More cautious investors who do not feel comfortable with being bounced around should instead opt for an open with bonds mixed in – for example, Schroder Managed Balanced.

If you're investing for the long term – to pay for your retirement adventures – and you're employed, often the most sensible course is to simply max out your workplace pension contributions.

'It is literally free money – as you get top-ups from your employer and the Government,' Wall adds.

2024-03-16T07:16:51Z dg43tfdfdgfd